|

[VIEWED 18813

TIMES]

|

SAVE! for ease of future access.

|

|

|

|

|

|

Captain Haddock

Please log in to subscribe to Captain Haddock's postings.

Posted on 12-20-06 9:53

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Thought some of you might find this article on financial services firms interesting: From The Economist Investment banks Coining it Dec 20th 2006

From Economist.com American securities firms have had a bumper year

IT HAS been a year to make even Croesus blush for the big Wall Street securities firms. Goldman Sachs, Bear Stearns, Morgan Stanley and Lehman Brothers have all announced record profits and beaten analysts’ expectations in the process. Bloomberg, a financial-information firm, calculates that the industry will make $29.1 billion after tax in fiscal 2006, a 43% rise on last year, which was itself a bumper one. New York’s tabloids have had a field day, splashing headlines like “Sachs of Loot†and fantasising about all the things outsized bonuses could buy.

Goldman, the best performer, is setting aside an unprecedented $16.5 billion to reward its talent, equal to $620,000 per employee across the firm. But it is now so profitable that the ratio of pay to revenue has actually fallen, to 43.7%, well below the 50% seen as a ceiling in the industry. And on Tuesday November 19th Goldman revealed that the bank’s boss, Lloyd Blankfein, would pocket $53.4m this year. This paypacket broke an industry record set only last week at Morgan Stanley—its chief, John Mack, will get around $40m for his work in 2006. The huge sums of cash and the attendant publicity prompted Mr Blankfein to call for humility as his troops reflect on their stellar year.

Even if some bankers do exercise a little modesty when it comes to spending their vast earnings this is unlikely to dampen the mood of purveyors of luxury goods and fancy homes, who hope to pick up more than a few crumbs from Wall Street’s table. Orders for bespoke suits are up on last year, says Jack Mitchell, who kits out some of Wall Street's financial bigwigs. New York officials are delighted, too. They have slashed the city’s budget-deficit forecast, in part because of the sharp rise in tax receipts from investment banks.

The banks can thank near-perfect markets for their good fortune. Mergers and private equity are booming, as are stockmarkets (the Dow Jones Industrial Average hit another record high on Tuesday). Volatility is low, credit still plentiful. Hedge funds and others are trading derivatives at a furious pace, providing a further lift to the banks’ prime-brokerage businesses. In these conditions, the banks have (so far) profited handsomely from ratcheting up their own risk-taking. Across the industry, value-at-risk—a measure of potential losses on a bad trading day—has risen steadily. Some 70% of Goldman’s net revenues now come from trading and investing on its own account.

Everyone knows this cannot last forever. The banks are hoping that their scope will help them when markets turn. Growth prospects look good in Asia and Europe, and all of the leading firms apart from Bear Stearns now do a big chunk of their business outside America. They are also beefing up their distressed-debt and bankruptcy teams, a source of profit that should mitigate any pain from a rise in defaults and tougher debt markets.

But with investment banks outperforming their commercial-banking counterparts on almost every measure, including share price, the gloating will be hard to contain. Just now, much of it is directed at Citigroup, which is under pressure to cut costs and raise its share price. Strikingly, the financial conglomerate is paying slightly higher interest on its five-year debt than Lehman or Bear Stearns.

Moreover, any investment banker worth his salt will tell you that there is not much money in meekness. After a day or two reacquainting themselves with their families at Christmas, most will race back to their desks next week, hungry to make another killing.

|

| |

|

|

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 12-24-06 8:08

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

stx: If the US falls into recession, China and the rest of the world will feel it too. Chinese need to export their goods somwhere. US is their biggest customer. I do not need you to look at my portfolio. I can do a good job myself. If you'd scroll up a bit, you'll see my P&L statement from last friday. That was just a 1 day gain, although I'd have to admit that it was the best day this month. I do not remember how long people have been talking about a recession in the US. Many still think that we are in a bear market and the market has been making new highs everyday. The past few weeks Nasdaq and Russell have underperfomed the SP, which could lead to a slight correction but nothing significant. I'll look to buy any dips here. Bear markets and recession are part of the business cycle and I'm sure we'll see it few times in our lifetime but not when eveyone is expecting it. I use stop losses on my portfolio and if the price declines by a cetain % from the high, I will be in cash.

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 12-24-06 9:06

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

That was my stock day trading account. I mostly trade futures. I'm long international high yield bond funds. This gives me the hedge against the weaking dollar. International high-yield bond funds returned more than 20% and after you convert that to dollar it returned more than 35% because the dollar has been weak. I have a trading system that I use. If you think that the market is efficient and chimpanzees are as good as human beings, then there is no need to even try. I think I might start another thread and discuss 1 or 2 basic strategies which if followed properly will make you decent money. I will start that probably after 2006. Need to take the dogs out for a walk. Later.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-25-06 2:07

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

agree with emnitrader on that futures are a good investment/tradng strategy. One of the biggest reasons is that you have a lower bound and an upper bound on how much you can gain or lose everyday . (correct me if I'm wrong)

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-25-06 2:25

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Glad to also see a lady in the thread. I cold be extemely wrong. samsara,I knew a grl by that name .... so just makin a gees. But anyways, holidays spending's sucked this time. I personaly expect only handful pf retailers to top expectations for thie qusrter and WALMART is OFF my radar. Cheap is sexpensive and Wal Mart's business model is failing. You can oly discount price so much without discounting the quality. With even the immigrants detesting Wal Mart's quality, it's days as a giant are numbered unless it explores into better quality "branded" stuff and not just "Geroge" lines for men. I was also shoced by how traders make more than the CEOs. I may end up being a trader myself- probably in the derivatives side. Don;t know what the commintment is like. If someone could give me insights into what derivatives trading is like- the hours, the pay, etc and maybe even trading in general for a large firm- my main focus is the hours... Thank you Meri Christimas

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 12-25-06 2:57

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Timetraveller, futures do have a lower and upper bound ranges but that is mostly in agricultural futures. It is called limit move. If the market moves limit-down and you are long the underlying, yuou are screwed. You might not be able to exit the position on time and will lose a lot of money. With index futures, there is no lower or upper bound ranges and since the index futures are pretty liquid, you can get out with a loss if you are wrong. Regarding your question about getting in on derivatives trading. Here is what you need. A degree from one of the top 10 schools with a very high GPA. If your major is Maths, Statistics, computer science, physics and as such, it will help. The top firms want a Phd to manage their derivatives desk. Most of the time is spent buliding models to figure out the right price. The pay is based on performance; either you make a load of money or you're fired. There is no in between.

|

| |

|

|

decalogT

Please log in to subscribe to decalogT's postings.

Posted on 12-25-06 8:04

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

This is really interesting thread. Thank you all for sharing important information. I am really naive to this field. So, how should I proceed? What are different options for investments? What are the important resources to get information (of course apart from googling ;))? It will be really informative for everyone interested in this topic if we could extend this thread to some kind of discussion group where we can get investment tricks from all you master investors out there :).

|

| |

|

|

redstone

Please log in to subscribe to redstone's postings.

Posted on 12-25-06 10:08

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

well, this thread could have been used in a way that would help new/old traders. but you two seem like throwing punches at each other. khutta tanney jasto, nepali ko jaat. anyways, I heard about $199 mil payout for Pfizer CEO. Even he did little for the company, his payouts were good. Forex opens tomorrow at 7am, ready to make some moolahs?

|

| |

|

|

Captain Haddock

Please log in to subscribe to Captain Haddock's postings.

Posted on 12-25-06 10:17

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Redstone, I sure could use 200 mil ... LOL! Will prolly be a slower week for shares. Not as active a trader anymore but will be re-organizing my portfolio the next couple of days. Wishing you all boatloads of money :)

|

| |

|

|

redstone

Please log in to subscribe to redstone's postings.

Posted on 12-25-06 10:22

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

thanks captain. Dunno about the market because cable closed 9500s on friday, and today it shot up to 9700s. we couldn't trade coz it was closed. It was showing on Northfinance charts. now its back to normal, 9500s. wtf! so that gives me a hint that something might happen, but englad got boxing day tomorrow, so tis their holiday. we'll see! thanks for the luck, i need it! :) wish you luck too!

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-26-06 9:57

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I'm not in one of the top 10 schools. I'm far from there. So I guess I'll just try my luck in I-Banking. Besides, if I do get into I-banking my chances of making money seem more than in derivaties modelling. And screw PhD. Don't have time for all that. :D Thanks eminitrader. TT

|

| |

|

|

Captain Haddock

Please log in to subscribe to Captain Haddock's postings.

Posted on 12-26-06 9:58

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Never invest in one basket and never believe in such hyped up selling that promises over 30% per annum as ROI. You can invest in any investment providing in generates in average more then your bank is giving you. " I agree completley about diverifying and deciding what rate of return you want to sell at (as hard as that might be to do sometimes.) As for 30%, yes, that is a high rate of return for the US markets. You need to make your own decisions about what you are buying and how much risk you want to put your money at. Of course, if you you look at these two India funds,for example, the story for the last one year, has been a bit different : ETGIX

Eaton Vance Grtr Ind;A MINDXMatthews Asian:India Again, these come with their risks and I can only people will weigh those in when making their decisions.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-26-06 9:58

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Oh, and how did you get into trading forex? Is this your hobby or your career? Just curious. It'd be so cool to have a society of Nepali Finance Professionals. NFP. YIA! TT

|

| |

|

|

Captain Haddock

Please log in to subscribe to Captain Haddock's postings.

Posted on 12-26-06 11:33

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

The Journal Report on alternative investments outside of stocks and bonds for the individual investor. Talks about commodities and hedge funds investments. Thought I'd post this based on some of the comments so far.

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 12-26-06 3:48

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

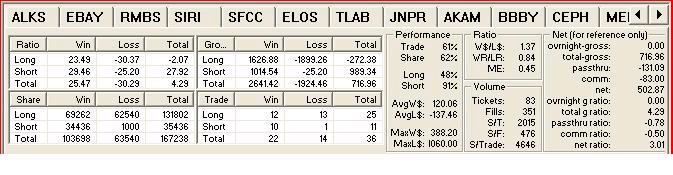

Not bad for a slow day.

|

| |

|

|

redstone

Please log in to subscribe to redstone's postings.

Posted on 12-26-06 5:08

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Slow day it is. Freakin slow. I won't be able to trade until tomorrow night, coz of work. I wouldn't say its my hobby or a full time job. Its just what i do, call it a part time job! :) 88 pips down since open, and i was away. just got home, so no profit in my bag. here is todays GBP/USD image :)

|

| |

|

|

DUKE1

Please log in to subscribe to DUKE1's postings.

Posted on 12-26-06 10:46

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Although some retracement is taking place; long term trend is intact. I am long at 1.9552 with stop 19.24. target 1.9650 Fib 38.2 is farway down to 93.29 but is reachable. Looking good so far; strategy Buy on the dips! Tight stop is neccessary as retracement levels are nearing. N.B the bottom trend line is slightly off! Risks see RSI

|

| |

|

|

DUKE1

Please log in to subscribe to DUKE1's postings.

Posted on 12-27-06 1:09

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Time traveller and Redstone check out mta.org Thats how u build up up ur resume to Wall St. It would be nice to have a trading room in ktm or thamel or even durbar marg and trade the Londong hrs.

|

| |

|

|

Samsara

Please log in to subscribe to Samsara's postings.

Posted on 12-27-06 6:17

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Timetraveller, Your analysis was way off the mark. I am a guy (whatever made you think I was not? A lot of Buddhist names can apply to both sexes: Sonam, Tashi, Karma, etc.)...BTW, Samsara is just a pseudonym. Great seeing an increased activity in this thread. I only log in during wkdays when bored at work (eg: the year end days)...Looks like we've totally strayed off the topic here. All the best in your trading folks!!

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 12-27-06 6:22

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Historically, Small caps have done really well the last few days of the year. Will it hold true again this year? I am taking rest of the year off. Will be back in 2007.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-27-06 9:38

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Eminitrader, are you a professional or did u learn these on your own? Either way it's very impressive that you and others are involved in this investment/trading business. Was wondering if mama's stock is going to rebound. Looks like it's just going through a cover for it's short sells these past few days. TT

|

| |